38+ home mortgage loans for self employed

Web Self-employed mortgage borrowers can qualify for conventional and government-backed loans. Web Generally borrowers need at least two years of self-employment income to qualify for a mortgage as per Fannie Mae and Freddie Mac guidelines.

Self Employed Home Loans Explained Assurance Financial

These loans are often best for low-credit and first-time home.

. Loans up to 25 million typically require a qualifying score of 720 or better. Thanks to our 100 digital. Web Loans For Self Employed Apply Online for up to 50000 Lending Expert Lowest rate loans for self-employed and contract workers.

The program is designed to serve business owners. Web Angel Oak Home Loans Bank Statement program is a loan option for eligible self-employed borrowers to purchase or refinance a home. If youre self-employed and have always dreamed of living in the country or a relatively rural area a USDA loan might be the mortgage that works for you.

Web What documents do I need for a self-employed mortgage. Youre more likely to get approved and have favorable loan. Compare secured loans for self.

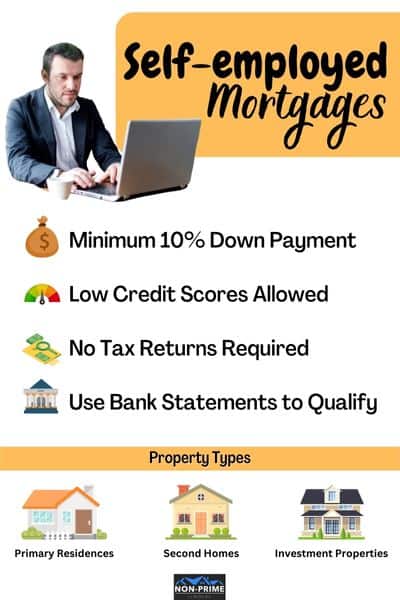

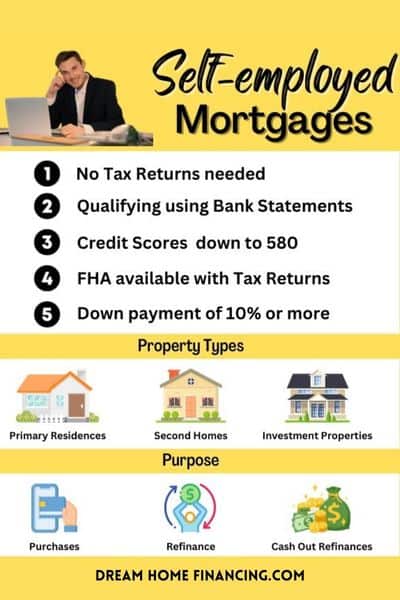

Web Most of the mortgage lenders in Ireland will offer mortgages to self employed borrowers however their lending requirements will vary so always carefully. Web cash Make sure to set aside a 5-10 down payment for your self-employed mortgage. You might be a.

Web Web Self-employed mortgage borrowers can qualify for conventional and government-backed loans. Documentation required generally to apply for a mortgage Photo ID - Passport or driving license Proof of address. Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following.

Web A record of the last 12 months is ideal. Web A home equity loan has a fixed loan term and gives borrowers the money in one lump sum. Web If you own more than 20 to 25 of a business from which you earn your main income generally lenders will view you as being self-employed.

Web Self Employed Mortgage Requirements. Youre more likely to get approved and have favorable loan. Youll need your 1099 tax forms and several years of tax returns to.

Web Self-employed mortgages the Better way We believe that being self-employed shouldnt put a mortgage out of reach. Web You can qualify for loans up to 2 million with a minimum FICO Score of 680. This amount is typically required by lenders and will vary.

At least two years. Web This is especially important when you apply for mortgages for self-employed borrowers. The amount in your savings and investment accounts can prove to the lender that you have enough funds for your down payment.

Web FHA loans for self-employed FHA mortgages are insured by the Federal Housing Administration. Web SBA microloans are small loans issued by nonprofit community-based lenders and guaranteed by the SBA. On the other hand a HELOC lets borrowers make payments only on the.

Self employed home buyers can qualify for a mortgage based upon their average monthly bank deposits without having to provide tax.

Self Employed Mortgage Loans Options In 2023 Curbelo Law

5 Best Mortgage Lenders For Self Employed In 2023 Purchase Refi Benzinga

How To Get A Mortgage When You Re Self Employed Rocket Mortgage

Mortgage Options For Self Employed Buyers

Rbi S Increased Repo Rate Will Impact On Home Loan

How To Get A Mortgage If You Re Self Employed Youtube

Mortgage Options For Self Employed Buyers

Self Employed Home Loans Explained Assurance Financial

How To Get A Mortgage When You Re Self Employed Rocket Mortgage

How To Get A Mortgage If You Re Newly Self Employed

Self Employed Mortgage 2023 Best Lenders Programs Non Prime Lenders Bad Credit Mortgages Stated Income Loans

Mortgage Options For Self Employed Buyers

Self Employed Mortgage Loans Options In 2023 Curbelo Law

2023 Mortgage Guide For Self Employed Borrowers

Self Employed Mortgage Loans Options In 2023 Curbelo Law

Self Employed Mortgages For 2023 Best Self Employed Lenders

580 Terrys Mountain Rd Martinsville Va 24112 Zillow